Guide to Farmland Investments in Chennai: Pros, Cons, and Costs

Introduction

Investing in farmland in Chennai offers the potential for long-term appreciation and regular income through agricultural activities or leasing. It provides diversification benefits for investment portfolios and can benefit from government incentives. However, investors must navigate weather risks impacting crop yields, legal complexities in land ownership, high initial acquisition costs, and ongoing expenses such as maintenance and operational costs. Understanding these financial considerations, including purchase prices, cultivation expenses, and legal fees, is crucial for making informed decisions and maximizing returns on farmland investments in Chennai. In this blog, we will discuss to explore the farmland investments of pros, cons, and costs

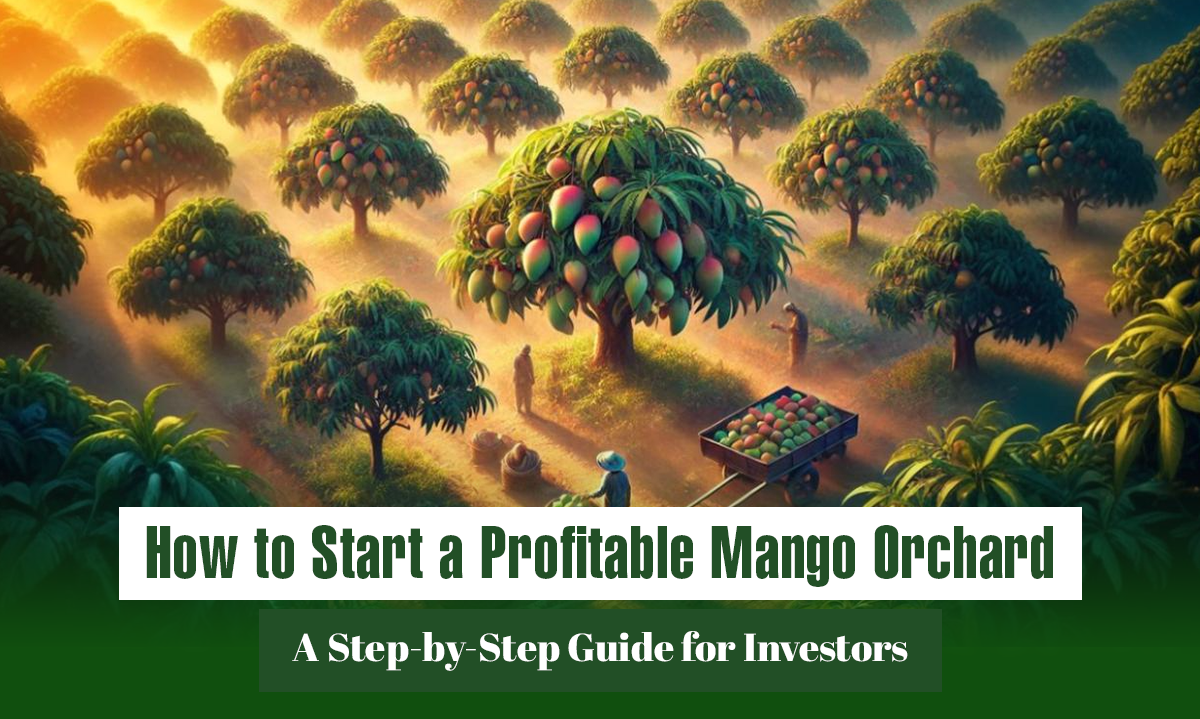

Pros of Investing in Farmland in Chennai

Agricultural Compensation: Farmland can deliver critical compensation through the turn of events and the proposition of yields. With Chennai's population growth and premium for new produce, farmers can expect predictable pay from neighborhood markets.

Land Appreciation: As metropolitan improvement develops, the value of farmland near Chennai is likely to increase. A financial sponsor can benefit from significant increases in land value over an extended period of time, providing a helpful leave philosophy.

Different Compensation Sources: Farmland can offer additional revenue sources, such as trained animal development, aqua-farming, and horticulture, in addition to previous standard reap creation. This expansion can generally increase benefits while reducing risks.

Agritourism: Agriculture Farmland can be developed for agritourism, attracting guests who are enthusiastic about experiencing rural life, traditional crafts, and outdoor entertainment. This can result in a consistent flow of substantial compensation.

Agricultural Cost Powers: Various boards, including India's, offer cost support for country work. Monetary allies can benefit from decreased charge liabilities on pay conveyed, making it a cost-doable endeavor.

Cons of Investing in Farmland in Chennai

Assessing Water Resources: In Chennai and the surrounding region, there won't ever be good water. This could significantly hinder development and increase the costs associated with establishing a water infrastructure.

Challenges of Farmland Acquisition: Acquiring farmland is a challenging enterprise because of the high costs, complex legal and regulatory requirements, and difficulty in finding suitable land with adequate soil and water availability. Financing can be challenging because of the perceived risks and the intense competition from other buyers.

Urbanization Strain: As towns around Chennai grow rapidly, green land may be converted into private or commercial plots. This could lead to a reduction in the size of green spaces and potentially alter the advantages of long-term theories.

Impact of Weather: The region is prone to crazy climatic circumstances like tropical storms, typhoons, and dry seasons, which can accumulate and make get-togethers less enjoyable.

Market Risks: The cost of green food can fluctuate rapidly due to factors such as shifts in market prices, problems within the creation alliance, and the movement of public funds. These all have an impact on pay strength.

Costs of Farmland Interests in Chennai

Initial Acquisition Cost: The primary expense in farming is the cost of purchasing the land. Depending on the location, size, soil quality, and area of metropolitan districts, expenses can vary significantly.

Legal and Registration Fees: Presenting and staying aware of water framework systems is basic for helpful development, especially in locales with clashing precipitation. Costs consolidate infiltrating borewells, setting up stream or sprinkler systems, and creating extra water rooms.

Irrigation Systems: The initial costs of area improvement, such as clearing, leveling, and soil redesign, can be significant in preparing the land for improvement. These activities may necessitate the hiring of equipment and labor, which can significantly increase the overall cost.

Fencing and Security: Securing the farmland with proper fencing to prevent unauthorized access and protect crops from wildlife incursions. Security measures might also include surveillance systems and hiring guards.

Key Considerations for Potential Investors

Market Trends and Demand: Describe the existing and anticipated market trends to determine compensation. Examine the progress of the industry and the new opportunities that are opening up. The client's directness and inclinations remain strong.

Financial Performance: Conduct an audit of the objective experience's cash-related aspects, such as pay and total compensations. Investigate verifiable spending plan reports and future projections. Consider the business's monetary strength and dissolvability.

Competitive Landscape: Identify key competitors and assess their market position. Dismantle contenders' qualities and insufficiencies. Analyze the potential as a component of the overall business development.

Regulatory Environment: Gain a thorough understanding of the administrative system that oversees the business. Remain informed about any upcoming changes to guidelines and rules. Examine how administrative consistency affects tasks and productivity.

Management Team: Evaluate the experience and history of the managerial group Assess driving limits and basic vision. Think about the social affair's capacity to explore inconveniences and drive improvement.

Conclusion

Investing farmland in Chennai can offer significant opportunities, but it also comes with challenges. The pros include high potential returns, land appreciation, and agricultural revenue. Cons may involve regulatory hurdles, climate risks, and market volatility. Costs encompass land purchase, labor, infrastructure, and maintenance. These blogs explained pros, cons, and costs of Investing farmland Chennai.

Latest blogs

JOIN OUR COMMUNITY !

Stay connected with Getfarms! Follow us on social media for the latest updates, exclusive offers, and a glimpse into the world of farmhouse living. Join our community today